straight life policy term

Assume that Company A buys a piece of equipment for 10500. Learn why AAA Life is a great choice for Term Life Insurance.

How Much Are Life Insurance Quotes Life Insurance Quotes Whole Life Insurance Life Insurance Marketing

Life insurance policies are generally purchased to provide coverage for an unforeseen unfortunate event like the insured persons death.

. AAA Life Term insurance covers a 10 to 30-year period during which the monthly or annual premium remains the same. A Universal Life Insurance policy is best described as aan. Which statement is NOT true regarding a Straight Life policy.

Whole life insurance also sometimes called ordinary or straight life insurance is the most common type of permanent policy. Annual renewable term life is a good choice for people who have short-term financial obligations or who want to cover a gap in employment until they get. Annually Renewable Term policy with a cash value account.

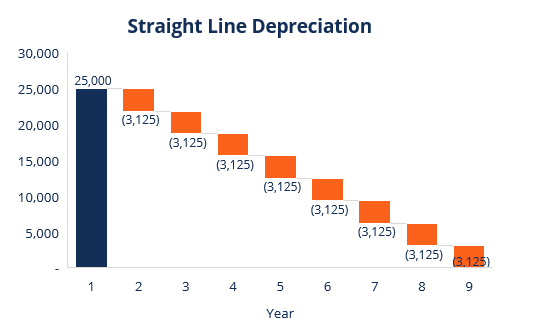

Oftentimes individuals can convert a current term policy to a permanent life insurance policy if they choose. The equipment has an expected life of 10 years and a salvage value of 500. Term life insurance or term insurance is one of the life insurance products that offer coverage for a specified term usually for a limited time period the applicable term.

Other variations such as. Its premium steadily decreases over time in response to its growing cash value. Term life insurance is a policy that offers cover for a set period of time when the term ends the policy lapses and if you survive the term then it wont offer a pay out.

Whole-of-life insurance offers a pay out no matter when you pass away it will cover you for the rest of your life. Term insurance provides financial security and protection for the family. Which of the following is TRUE about credit life insurance.

Example of Straight Line Basis. Creditor is the policyowner. But your term policy can change as your needs do.

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

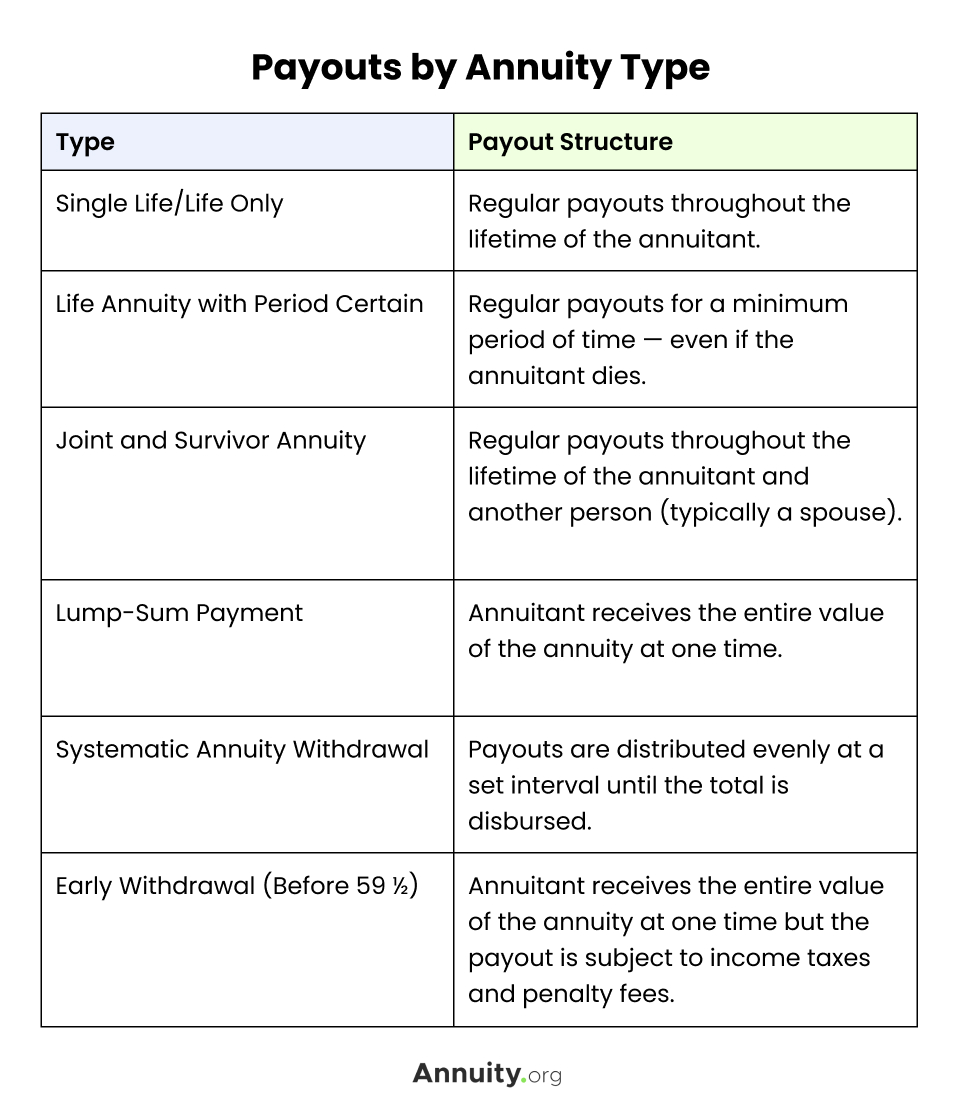

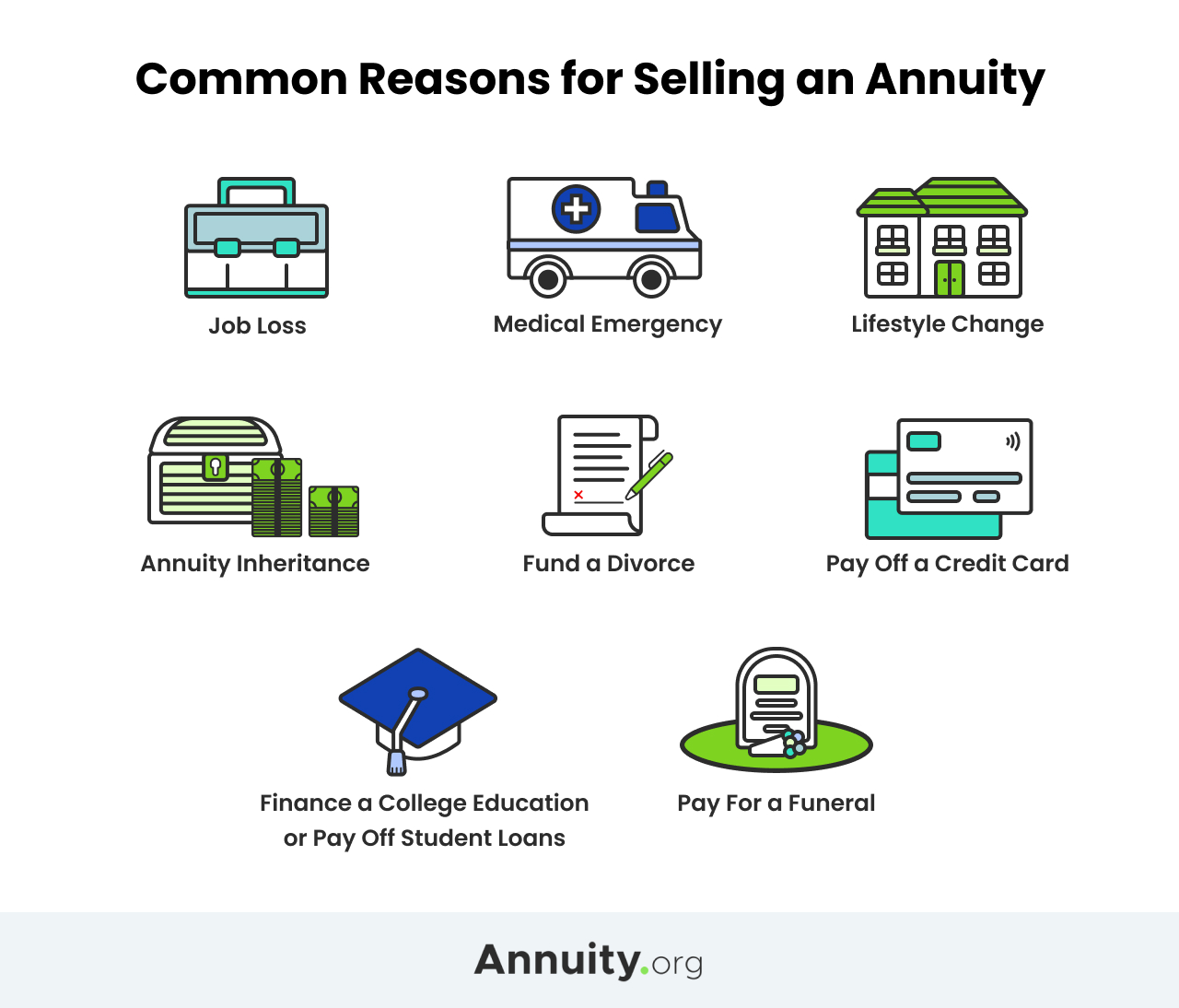

Annuity Payout Options Immediate Vs Deferred Annuities

Straight Line Depreciation Formula Guide To Calculate Depreciation

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

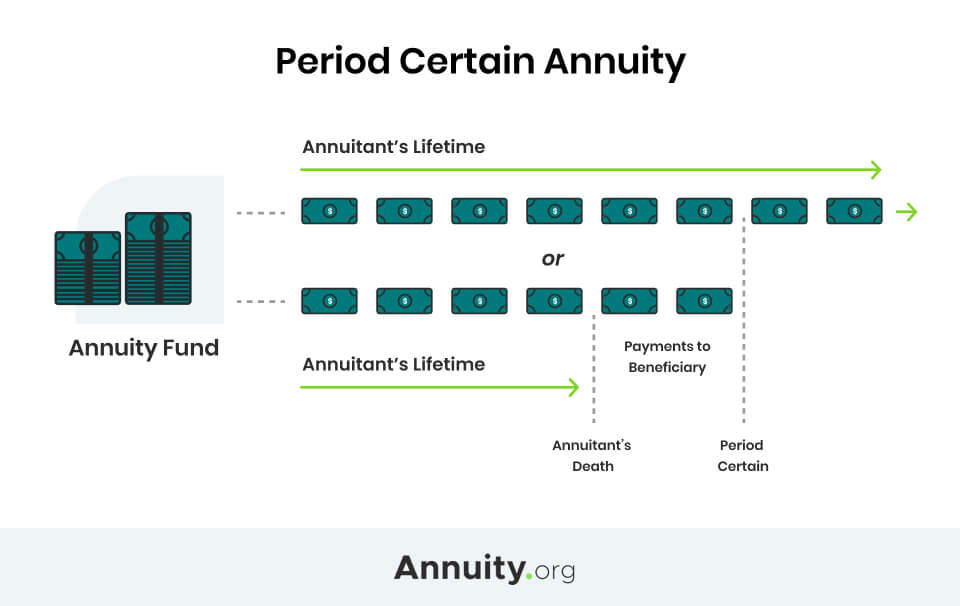

Period Certain Annuity What It Is Benefits And Drawbacks

Annuity Payout Options Immediate Vs Deferred Annuities

10 Best Tips If You Re Buying Life Insurance For The First Time Forbes Advisor

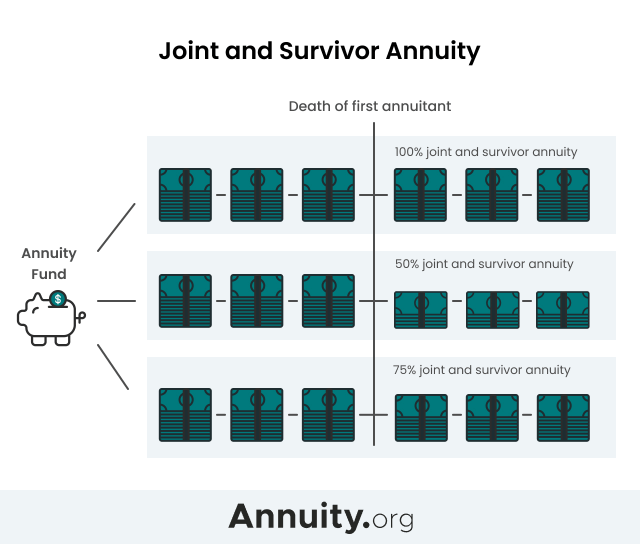

Joint And Survivor Annuity The Benefits And Disadvantages

Depreciation Methods 4 Types Of Depreciation You Must Know

Why Buying Health Insurance Is Important Health Insurance Infographic Buy Health Insurance Life Insurance Marketing Ideas

Choosing The Right Term Insurance For Young Life Stage

Depreciation Methods 4 Types Of Depreciation You Must Know

When Can You Cash Out An Annuity Getting Money From An Annuity

Straight Life Annuity Definition

Looking For The Best Rates On Life Insurance For All 50 States We Can Help In 2021 Insurance Life Insurance Exam

Lcx Life A Life Insurance Settlement Company Life Life Insurance Health Challenge

Life Insurance Converage Life Insurance Quotes Life And Health Insurance Life Insurance Marketing Ideas

/GettyImages-184985261-257061c6b35546779a16b51ca1e9da8e.jpg)